Posted on

August 7, 2024

by

Andrew and Jill Hasman

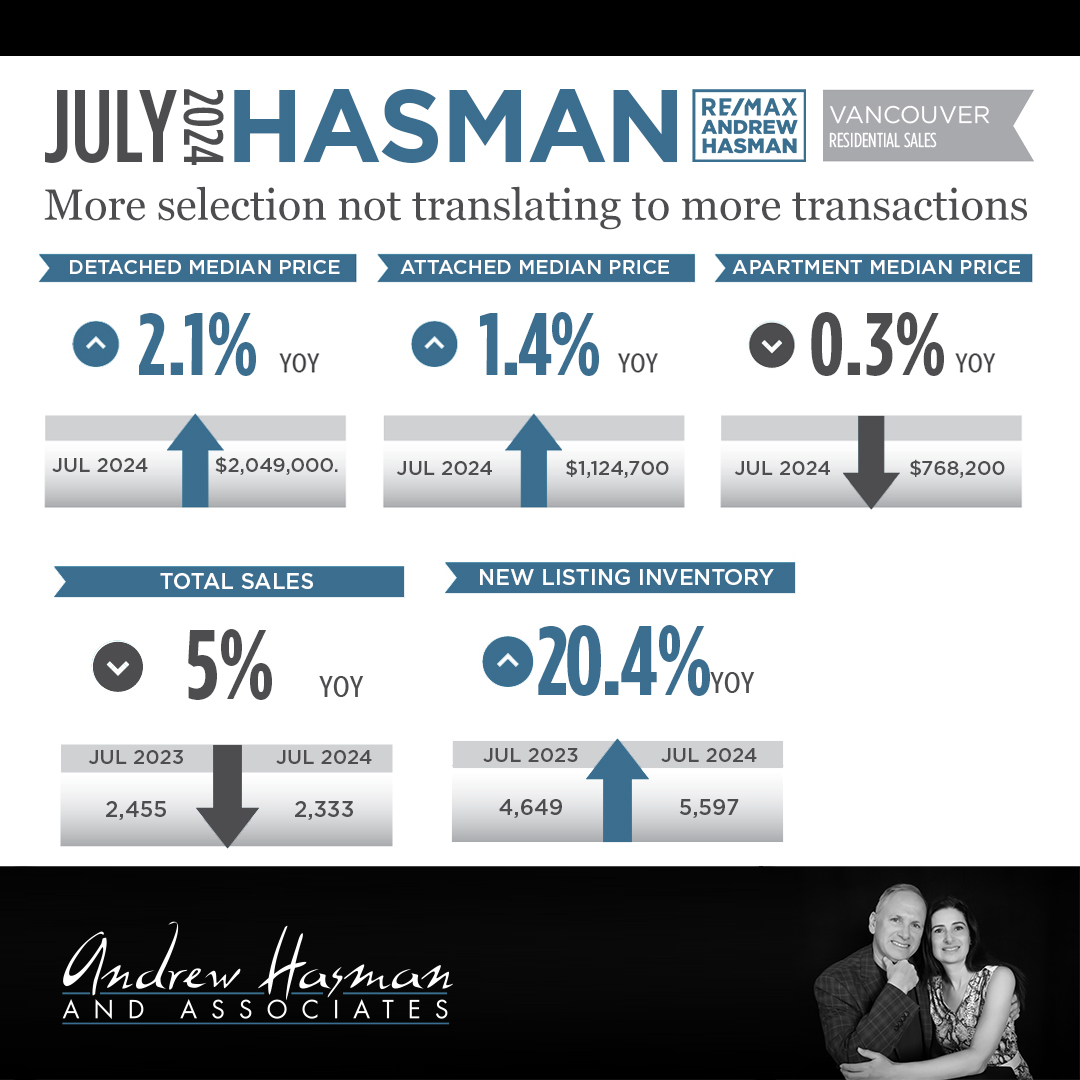

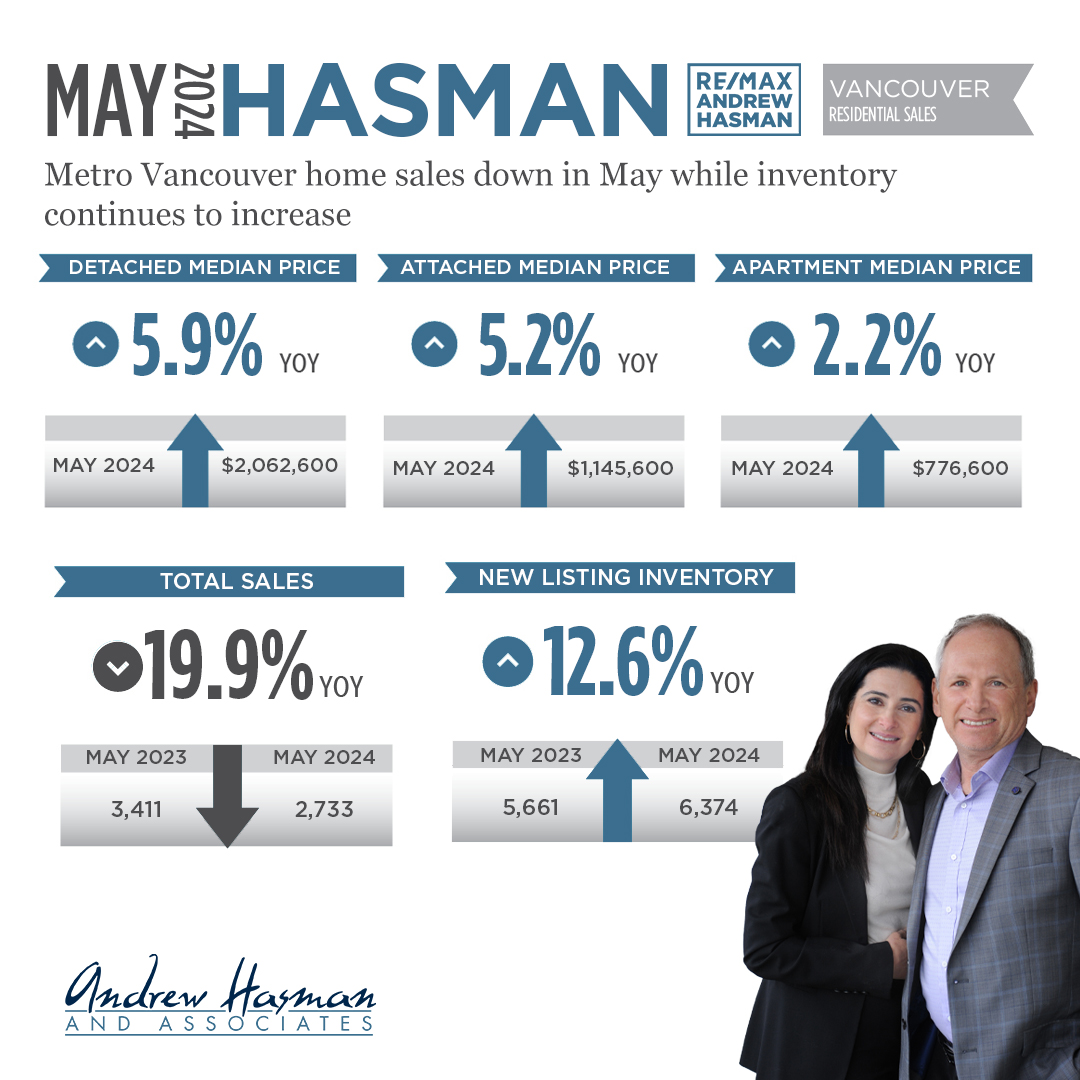

Newly listed properties registered on the Multiple Listing Service® (MLS®) rose nearly twenty per cent year over year in July, helping to sustain a healthy level of inventory in the Metro Vancouver housing market.

On the demand side, the Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,333 in July 2024, a 5 per cent decrease from the 2,455 sales recorded in July 2023. This was 17.6 per cent below the 10-year seasonal average (2,831).

"With the recent half percentage point decline in the policy rate over the past few months, and with so much inventory to choose from, it’s a bit surprising transaction levels remain below historical norms as we enter the mid-point of summer."

There were 5,597 detached, attached and apartment properties newly listed for sale on the MLS® in Metro Vancouver in July 2024. This represents a 20.4 per cent increase compared to the 4,649 properties listed in July 2023. This was also 12.7 per cent above the 10-year seasonal average (4,968).

The total number of properties currently listed for sale on the MLS® in Metro Vancouver is 14,326, a 39.1 per cent increase compared to July 2023 (10,301). This is also 21.5 per cent above the 10-year seasonal average (11,788).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for July 2024 is 16.9 per cent. By property type, the ratio is 12.8 per cent for detached homes, 20.1 per cent for attached, and 19.3 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“With the overall market experiencing balanced conditions, and with a healthy level of inventory not seen in quite a few years, price trends across all segments have leveled out with very modest declines occurring month over month," Lis said.

“While it remains to be seen whether softening prices and improved borrowing costs will entice buyers to purchase as we head into the fall market, it’s worth noting that it can take a few months for improvements to borrowing costs to materialize into higher transaction levels.

"In this respect, it’s still early days, so we will watch the market for signs of transaction activity picking up in the months ahead.”

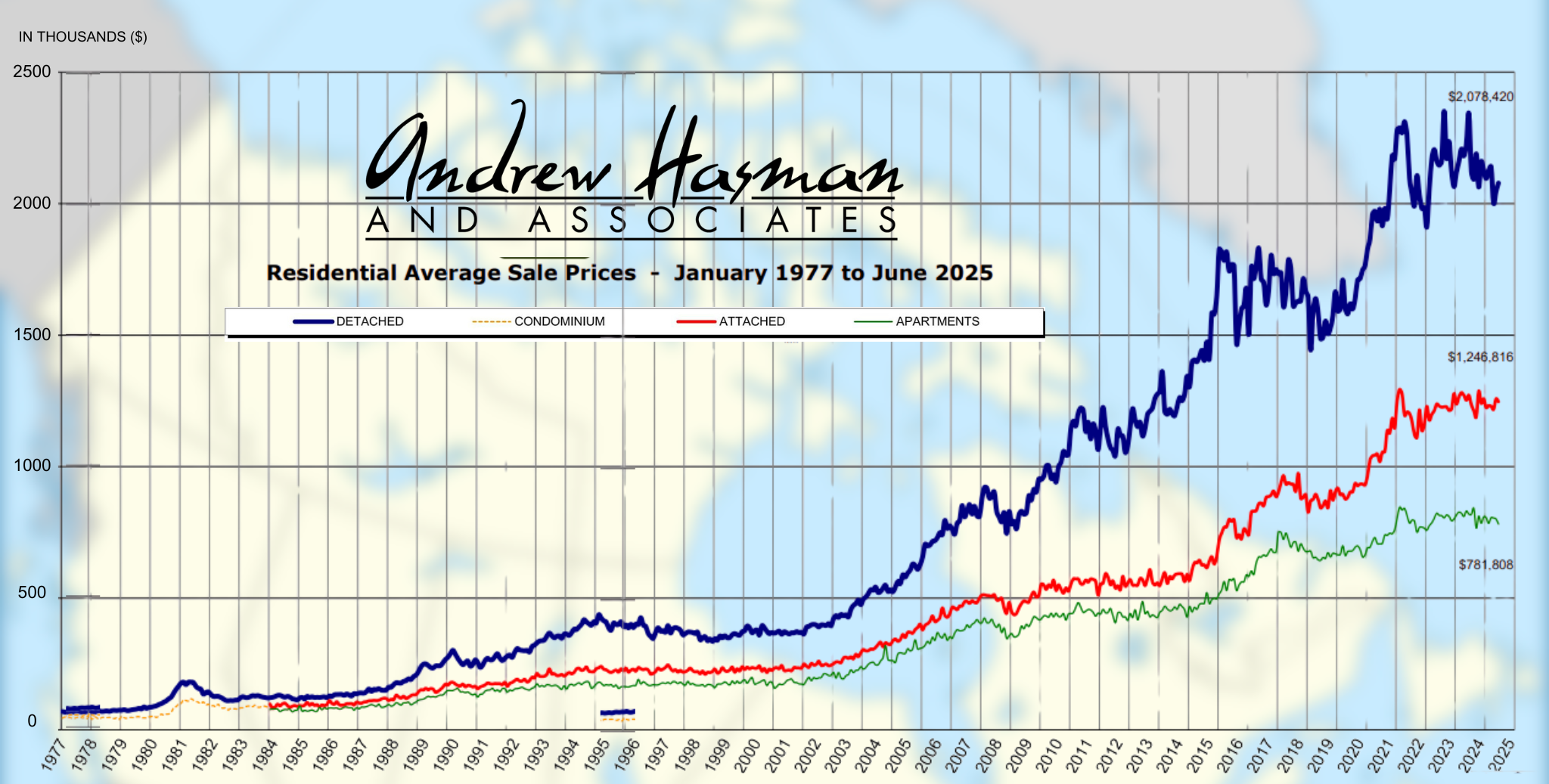

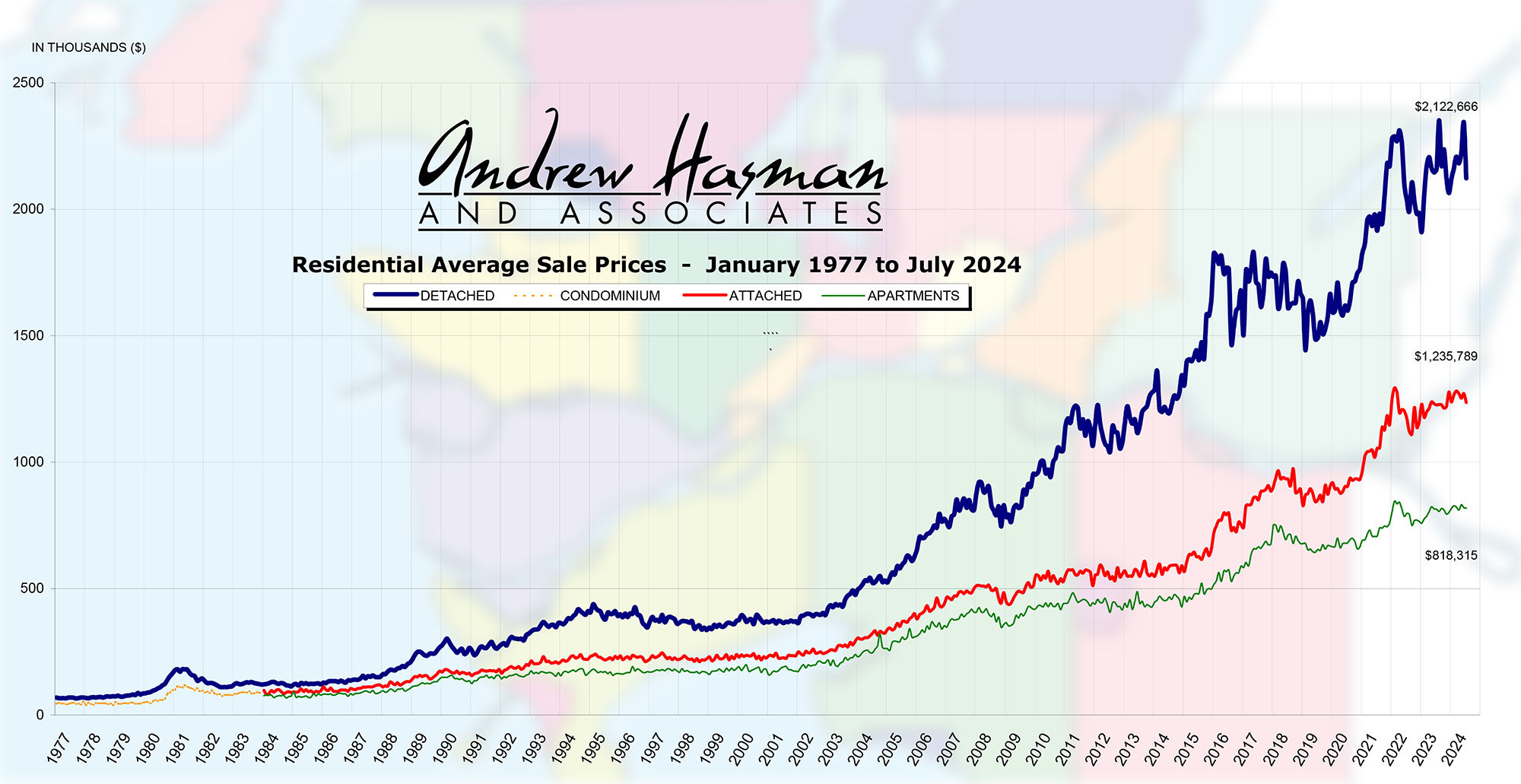

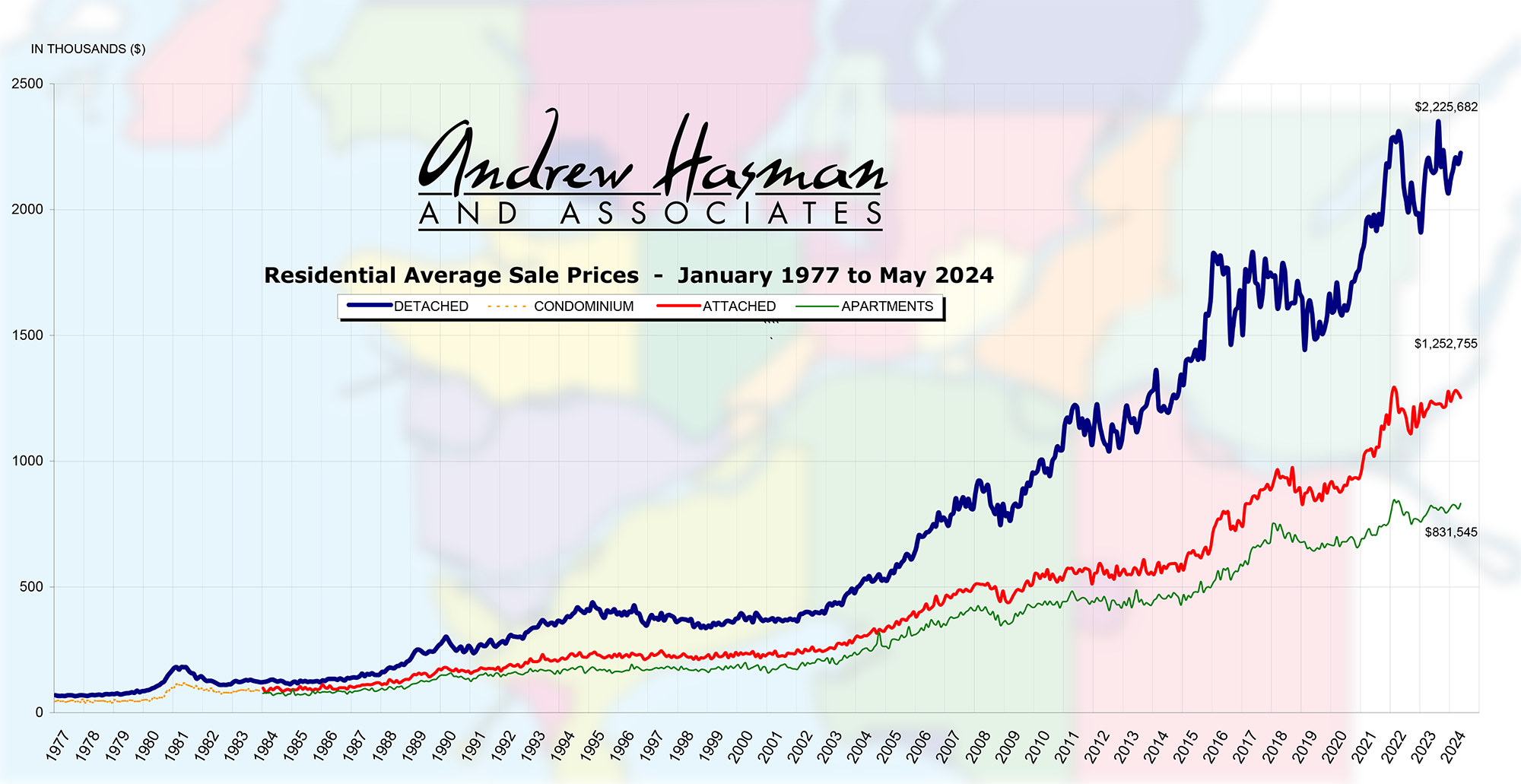

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,197,700. This represents a 0.8 per cent decrease over July 2023 and a 0.8 per cent decrease compared to June 2024.

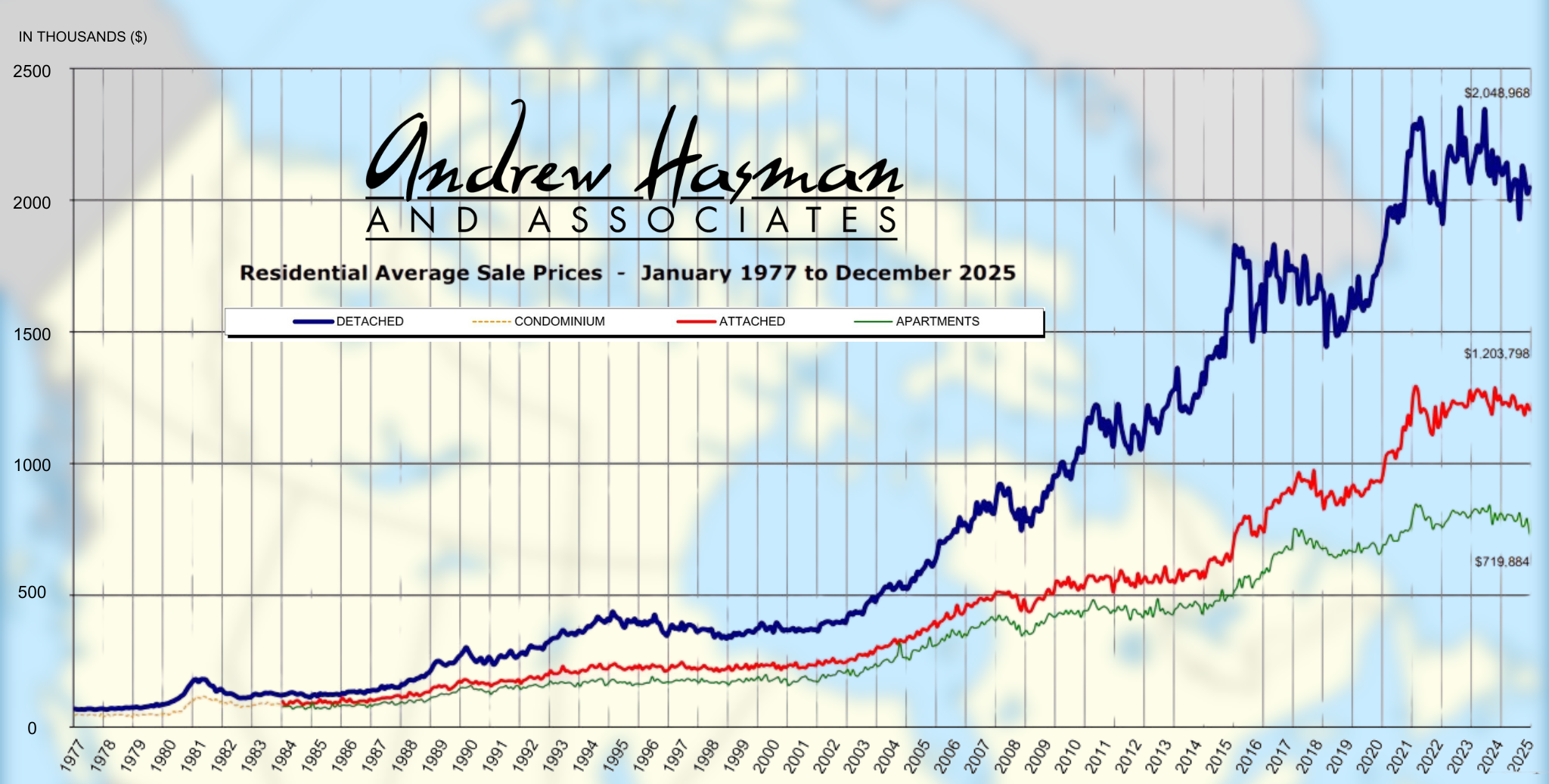

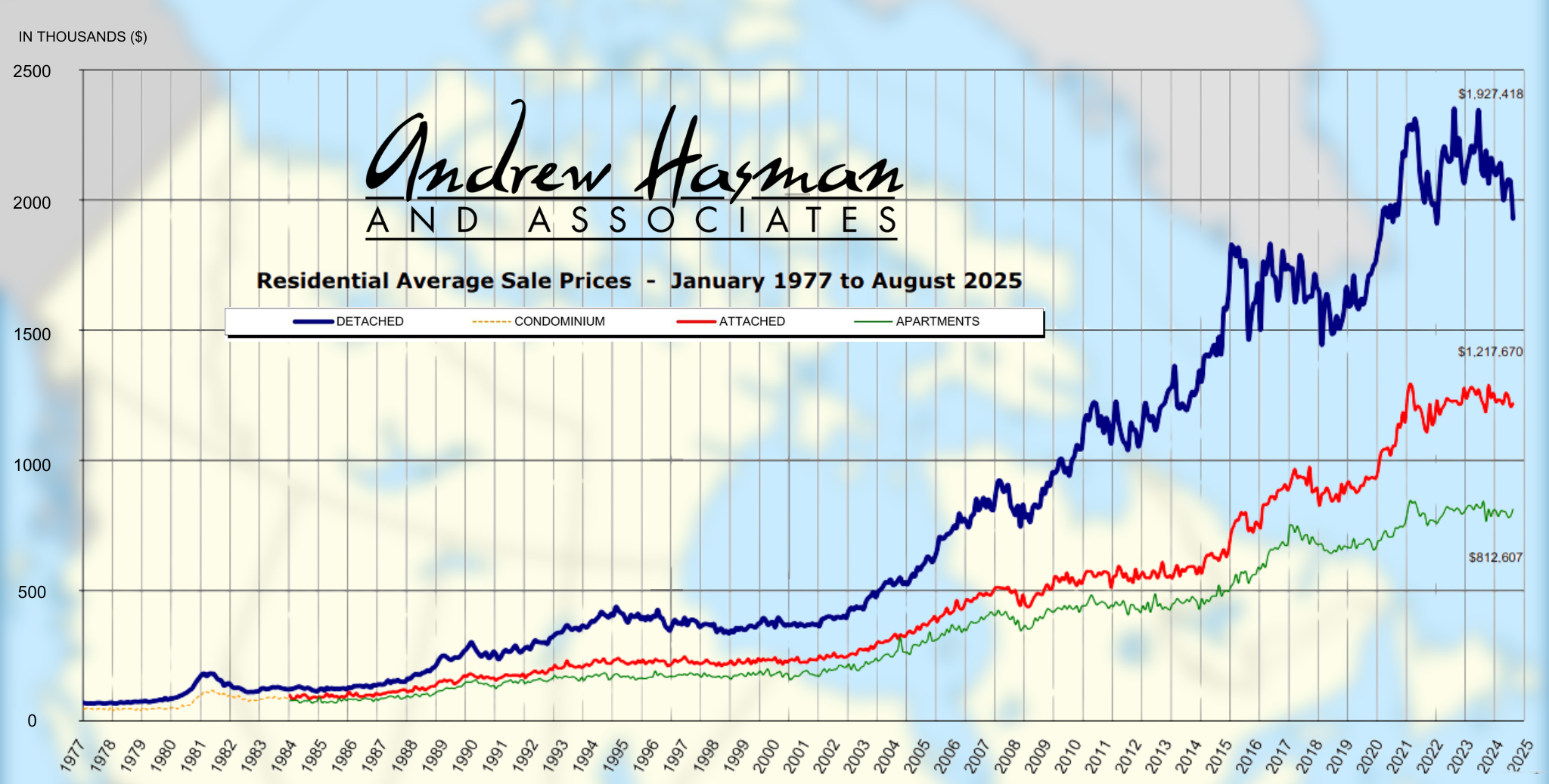

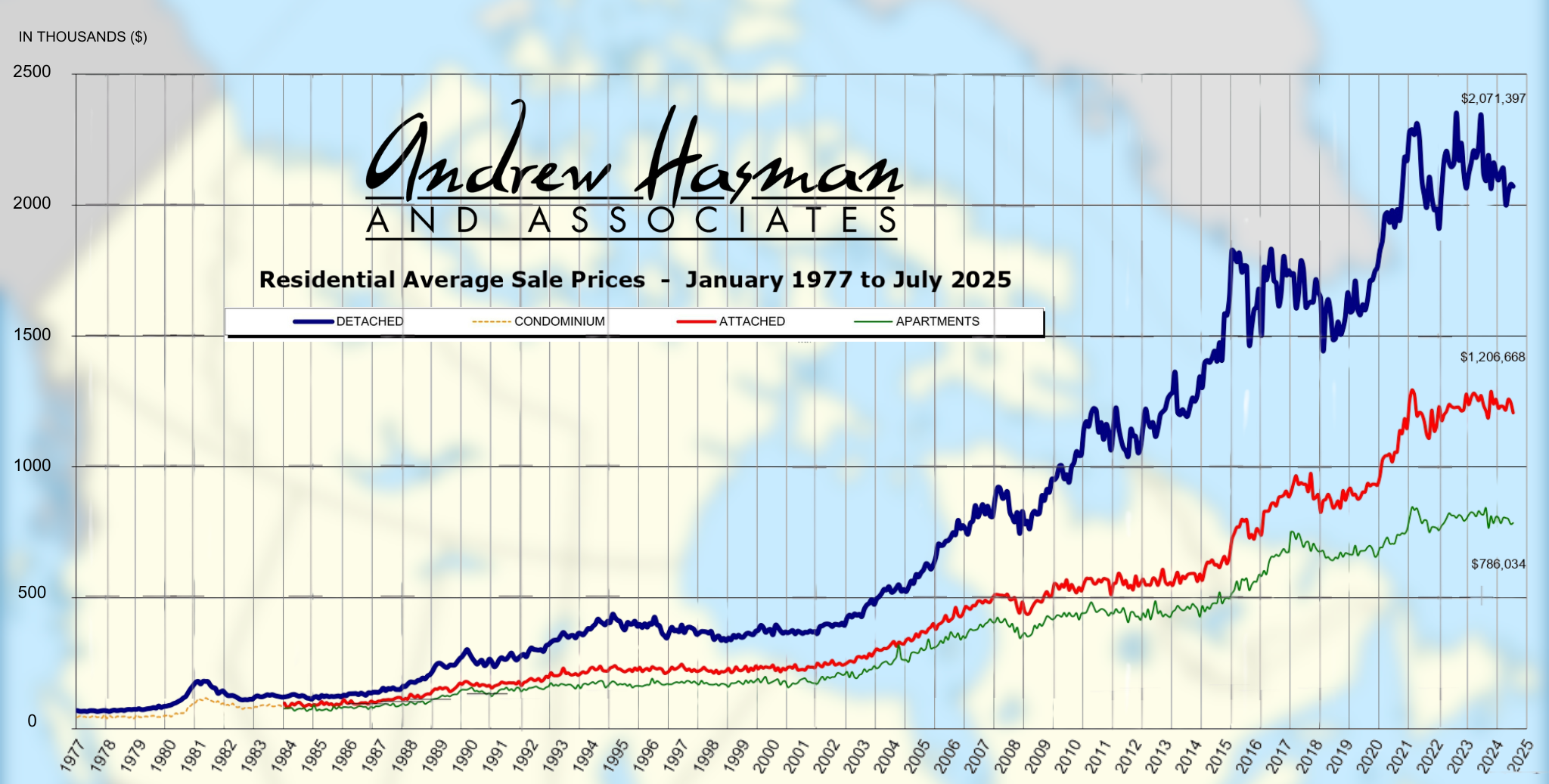

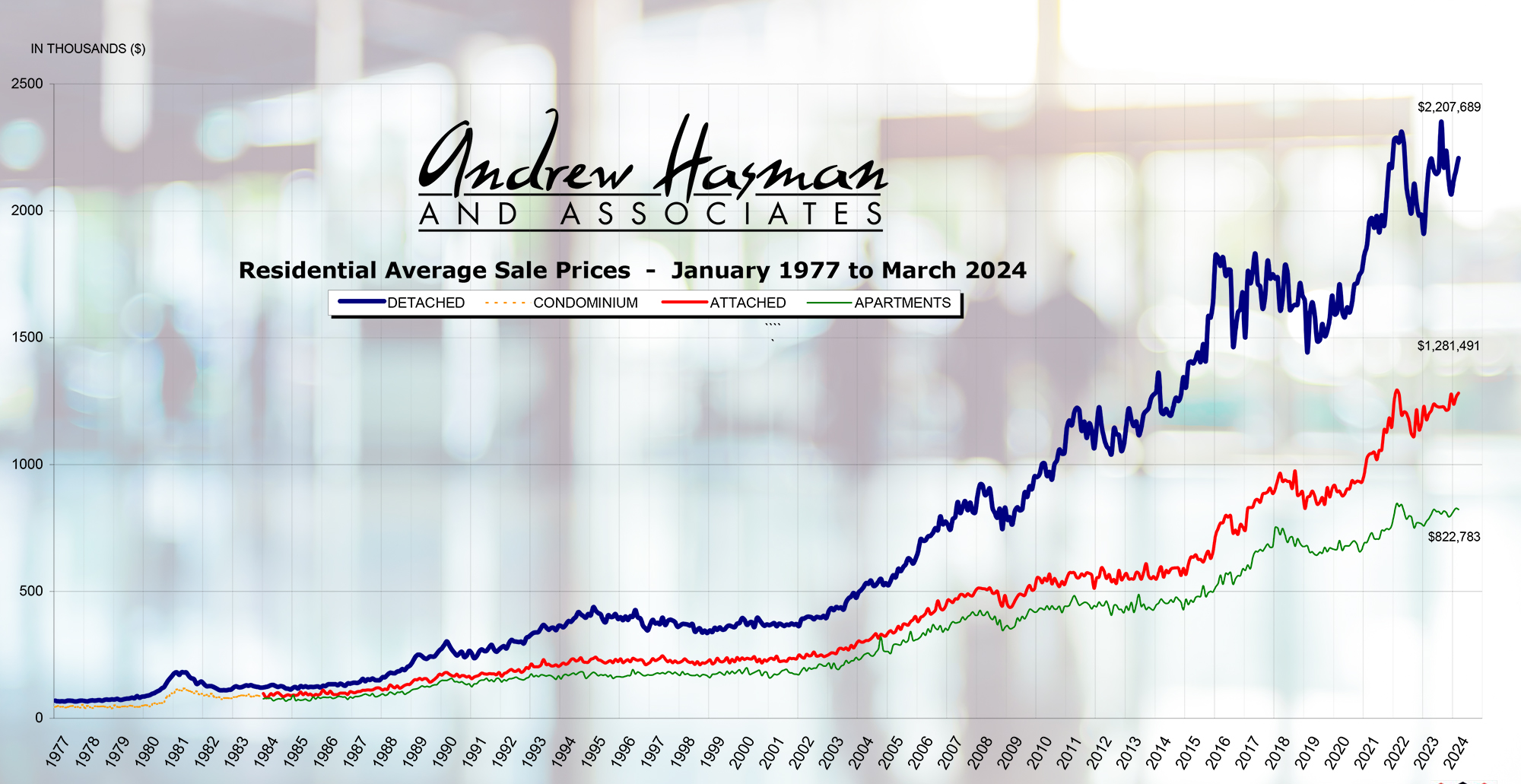

Sales of detached homes in July 2024 reached 688, a 1 per cent increase from the 681 detached sales recorded in July 2023. The benchmark price for a detached home is $2,049,000. This represents a 2.1 per cent increase from July 2023 and a 0.6 per cent decrease compared to June 2024.

Sales of apartment homes reached 1,192 in July 2024, a 6.9 per cent decrease compared to the 1,281 sales in July 2023. The benchmark price of an apartment home is $768,200. This represents a 0.3 per cent decrease from July 2023 and a 0.7 per cent decrease compared to June 2024.

Attached home sales in July 2024 totalled 437, a 6.2 per cent decrease compared to the 466 sales in July 2023. The benchmark price of a townhouse is $1,124,700. This represents a 1.4 per cent increase from July 2023 and a 1.2 per cent decrease compared to June 2024.

Contact us for more information